FORM 6 – SALE OF LAND BY PUBLIC TENDER

Municipal Act, 2001 – Ontario Regulation 181/03 – Municipal Tax Sales Rules

The Corporation of the Municipality of West Nipissing

Take Notice that tenders are invited for the purchase of the land(s) described below and will be received until 3:00 p.m. local time on Wednesday, July 9, 2025, at the Municipal Office, 101 – 225 Holditch Street, Sturgeon Falls, ON P2B 1T1.

The tenders will then be opened in public on the same day as soon as possible after 3:00 p.m. at the Municipal Office, 101 – 225 Holditch Street, Sturgeon Falls and will also be opened and publicly available via live stream on the Municipality’s web site on the same day as soon as possible after 3:00 p.m.

This tax sale is closed. The property has been redeemed.

Description of Lands

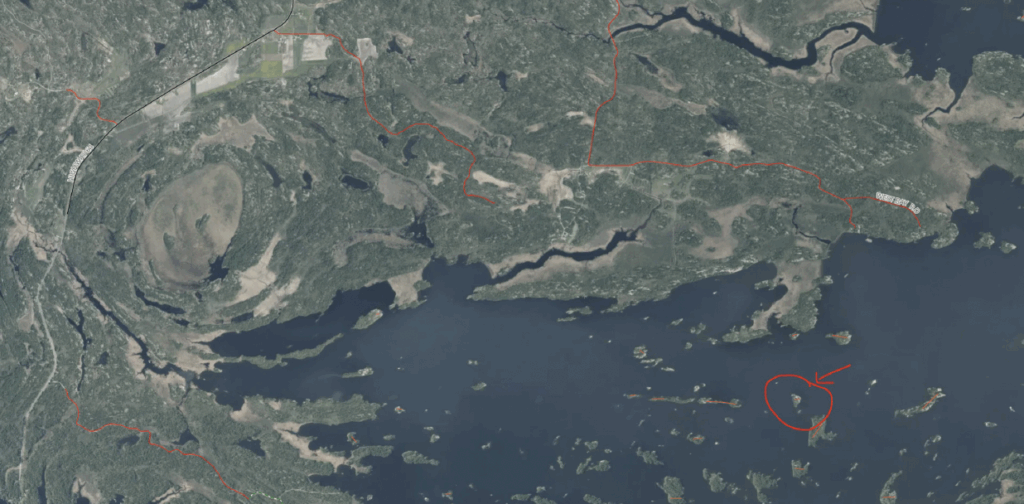

ROLL NO. 48 52 090 001 22900 0000, MONETVILLE, PIN 49231-0252 LT, PCL 12774 SEC NIP; CROW ISLAND IN THE WEST BAY OF LAKE NIPISSING, IN FRONT OF LOUDON; WEST NIPISSING ; DISTRICT OF NIPISSING, FILE NGWN23-021

Minimum Tender Amount: $38,033.74.

According to the last returned assessment roll, the assessed value of the land is $470,000.

Except as follows, the municipality makes no representation regarding the title to, existing interests in favour of the Crown, environmental concerns or any other matters relating to the land(s) to be sold. Any existing Federal or Provincial Crown liens or executions will remain on title and may become the responsibility of the potential purchaser. Responsibility for ascertaining these matters rests with the potential purchasers.

This sale is governed by the Municipal Act, 2001 and the Municipal Tax Sales Rules made under that Act. The successful purchaser will be required to pay the amount tendered plus accumulated taxes and any taxes that may be applicable, such as a land transfer tax and HST.

Effective January 1, 2023, in accordance with the Prohibition on the Purchase of Residential Property by Non-Canadians Act (SC 2022, c 10, s 235) (the “Act”), non-Canadians are now prohibited from purchasing residential property in Canada, directly or indirectly, pursuant with the terms as set out in the Act and Regulations under the Act.

Any non-Canadian who contravenes the Act, or any person who knowingly assists in contravening the Act is liable to a fine of up to $10,000 and may be ordered that the property be sold, therefore it is highly recommended that any potential purchasers obtain independent legal advice to ensure they will not be in contravention of the Act.

It is the sole responsibility of the tenderers to investigate into the details of what constitutes a non-Canadian, residential property, any exceptions or exclusions, or any other matters or determinations relating to the Act. The municipality accepts no responsibility whatsoever in ensuring that any potential purchasers comply with the Act.

Non-Resident Speculation Tax (NRST) applies to the purchase price for a transfer of residential property located in Ontario which contains at least one and not more than six single family residences if any one of the transferees is a non-resident of Canada, foreign entity or taxable trustee.

The municipality has no obligation to provide vacant possession to the successful purchaser.

A copy of the prescribed form of tender is available on the website of the Government of Ontario Central Forms Repository under the listing for the Ministry of Municipal Affairs.

For further information regarding this sale and a copy of the prescribed form of tender contact:

Najette Goulard, Municipal Tax and Revenue Collector

The Corporation of the Municipality of West Nipissing

101 – 225 Holditch Street

Sturgeon Falls, ON P2B 1T1

(705) 753-6903